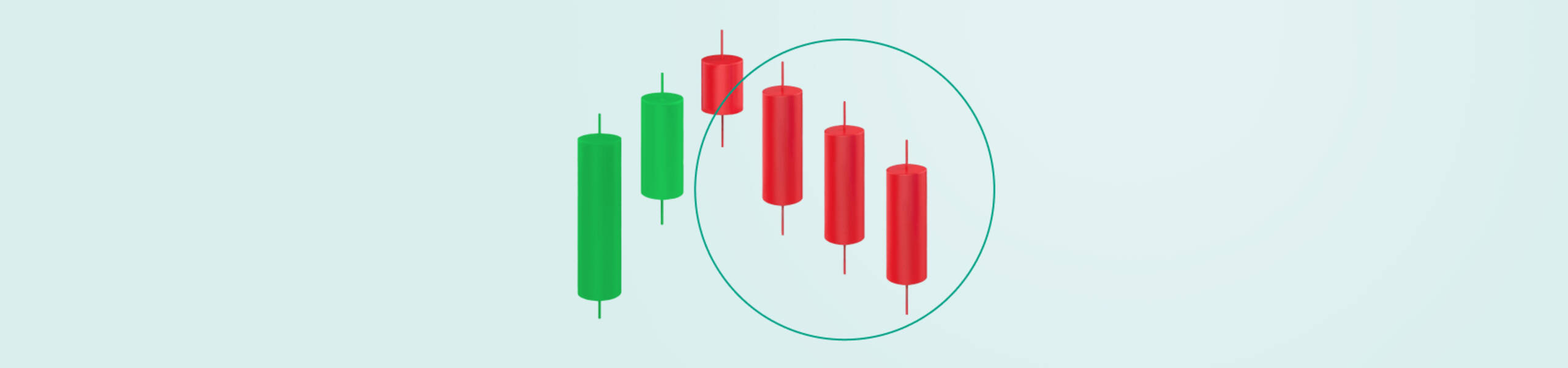

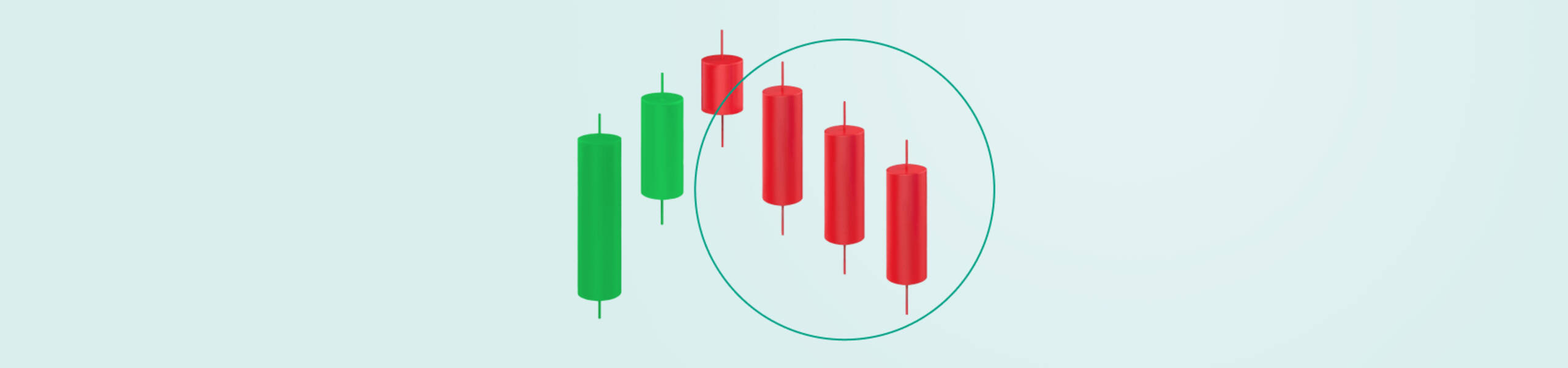

In trading, we can rely on a bunch of different entry signals.

2024-05-28 • Updated

The stock market is full of various indices. Nasdaq is just one of them. But why is it so popular among traders? What makes it so special? Let’s find out.

There are the Nasdaq Composite Index and the Nasdaq 100 index. Don’t be confused. The former consists of all Nasdaq domestic and international stocks listed on the Nasdaq Stock Market. Whereas, the Nasdaq 100 is an extract of the Nasdaq Composite, which has only 100 top non-financial companies. Besides, the Nasdaq 100 is also known as US 100. On the chart below, you can see the Nasdaq 100.

Nasdaq 100’s main difference from other indices such as S&P 500 and Dow Jones is that it mainly consists of stocks of the technology sector (47.25%). That’s why investors call it a benchmark for the US tech stocks or just the tech index. The rest of it belongs to consumer services (19.37%), health care (10.13%), and consumer goods (7.82%).

The coronavirus sent tech stocks soaring as the demand for e-commerce, cloud technologies, and streaming services skyrocketed during long lockdowns. Digitalization has started well before the pandemic, but it speeded up that tendency. As a result, Nasdaq surged to unimaginable highs! It has managed to rise by nearly 60% since January 2020.

The NASDAQ-100 index is weighted by the market capitalizations of its companies. In other words, all value of the index equals the aggregate value of the share weights, also known as the index shares, of each of the index securities multiplied by each such security's last sale price, and divided by the divisor of the index.

Why is it important? This weighting allows limiting the influence of the largest companies and balancing the index with all members. No company of the Nasdaq-100 can have more than a 24% weighting. But still, when larger companies' stocks rise or fall, it has a greater influence on the index than the stocks of smaller companies.

Overall, there are 102 symbols due to several companies with two share classes. For example, Google's parent company Alphabet has Class A (GOOGL) and Class C (GOOG) shares in the index.

Here’s the list of top stocks in the Nasdaq index, where you can find well-known companies from Apple to Tesla.

First of all, you should open the proper contract. Don’t be confused, in MetaTrader, you’ll find two tools: Nasdaq and Nasdaq-*the current year and a letter*. The former one is just for analyzing, not for trading. The second one is for trading. What is great about trading contracts is that a person can trade in both directions, just like you trade currencies. In other words, you can take advantage of its price movements by buying or selling it.

So, to open the contract, click on the button “Create a new chart” in the left upper corner, then push the following buttons as in the picture below.

After that, you’ll get a chart of the contract, which expires at a specific time. To know the expiry date, go to the specification of the contract by clicking the right button on the contract of Nasdaq as shown below. Then, you’ll find the time of the last trade. If you don't want to bother with expiry date, US 100 will be perfect for you.

In the FBS Trader app, it’s even easier. You should just click on the button “Indices” and then you’ll find in the dropdown list the needed contract.

Now you know what is Nasdaq and how to trade it! Follow earnings reports, companies’ news, and product launches to be always updated. In fact, the future is with technologies. And since Nasdaq is a tech index, it has a high potential to grow further to new highs. Moreover, by trading indices instead of individual stocks, you minimize the risks of unexpected price movements based on the sudden news releases of one company.

In trading, we can rely on a bunch of different entry signals.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Trading has several levels of complexity, starting from the easiest, like buying and selling random assets, to a more comprehensive one, with deliberate risk management, timing, and objectives.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!